Protect your money – go for gold!

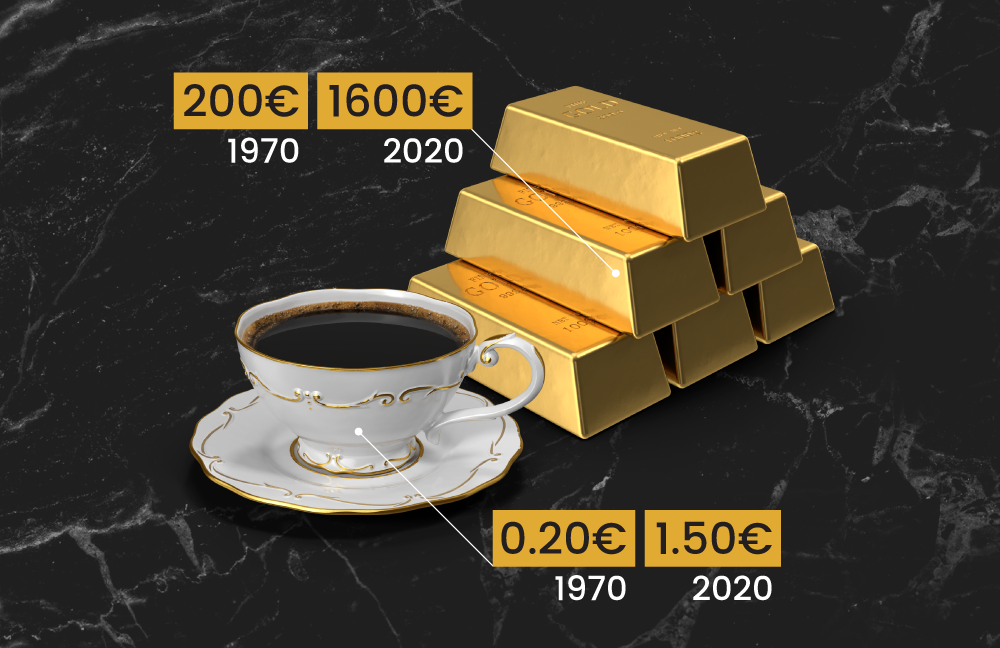

A cup of coffee in the 1970s was 20 cents, today – it’s EUR 1.50. Meanwhile, an ounce of gold in the 1970s was EUR 200, today – it’s more than 8 times that price. What do these two commodities have in common, you may wonder? Inflation.

Gold – a safe haven from inflation

Both wealthy people and companies constantly look for ways to protect their money from inflation. While some choose to invest in things like shares and real estate – others fear the risk of losing money and go for the time-tested method of preserving the purchasing power of their money – gold.

Although gold prices do fluctuate daily, in the long term (10-20 years) it is known to be a low-risk investment, whose value is proportional to the rate of inflation – the higher the inflation, the higher the gold price.

Here we say “investment” purely in the sense of wealth-preservation, not in the speculative sense. And since the gold price is affected by other factors than prices of shares and obligations – it is considered a great means of portfolio diversification, used by central banks all over the world.

Gold available for everyone

Inflation affects everybody – some people for better, many – for worse. Therefore we believe that gold should be available for everyone too. And not just any gold, like grandmother’s earrings or white gold from the pawnshop down the road, but real physical investment gold.

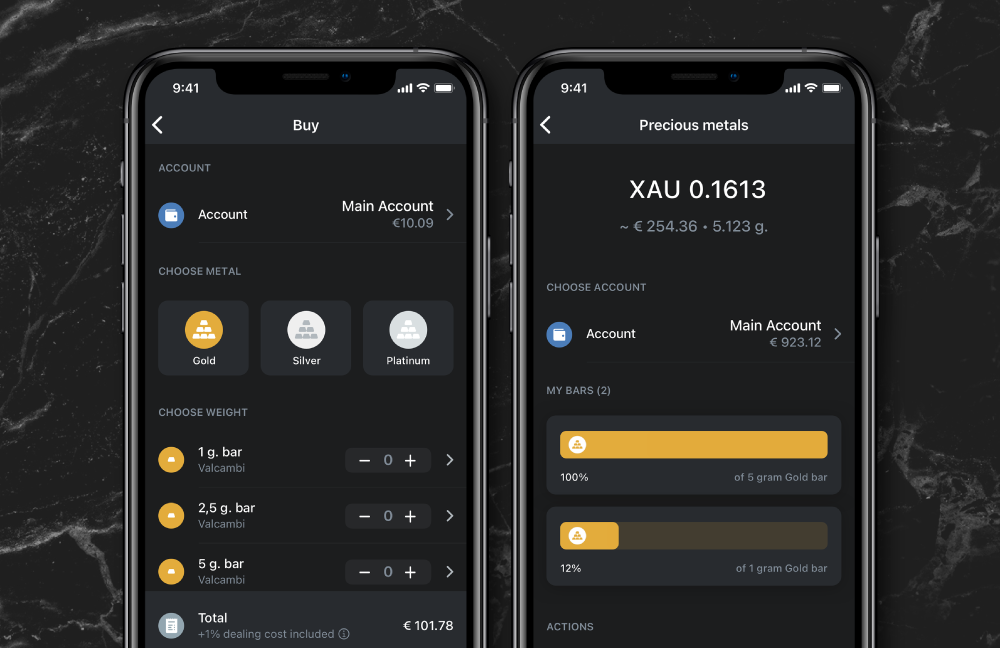

Via the Paysera mobile app, all Paysera clients (and it is FREE to become one) can purchase physical gold not just in coins and bars but also in smaller parts for as little as one euro. That’s how gold becomes a commodity available for everyone in the digital age and during fears of inflation.

Inflation takes from the ignorant and gives to the well informed.

Venita VanCaspel