Paysera transfers on hold? Here's what you need to know

A quick disclaimer

As a licenced electronic money institution, Paysera bears a great responsibility in ensuring safe and secure financial transactions for our clients. Compliance with regulations and preventing suspicious activity is of utmost importance to us.

That’s why, in some cases, we may have to stop a transfer to protect your finances. We take this decision seriously and always aim to assist you in getting your transfers back on track. So, if you ever encounter a stopped transfer, rest assured that it's for your own protection, and we'll do everything in our power to ensure a speedy resolution – we only ask for your cooperation.

However, there are instances where transfers may be halted for reasons unrelated to safety precautions, and the process is often straightforward. Let’s explore these situations in greater detail.

Possible reasons why transfers are being stopped (or why you can’t proceed)

Let’s start with the easy ones – the ones that you can fix yourself, without the help of client support. All you need to do is ask yourself the following questions.

Do you have enough funds for the transfer?

Perhaps you mistyped the amount you want to transfer and added one too many zeros? Or could it be that you forgot about the fees and only calculated the amount you want to transfer?

Solution: Take a quick moment to double-check if you have enough funds available for the transfer and check the possible fees.

Are the transfer details correct?

No judgement here – it happens to the best of us. It could be human error where you have accidentally mistyped transfer details.

Solution: We recommend taking a moment to carefully review all the transfer details before proceeding. Specifically, make sure that the recipient’s account number and other details are accurate and up-to-date.

Is your account verified?

As part of our standard procedures, we require all new users to complete a KYC (Know Your Client) questionnaire. We know it can take a bit of time to complete, but by providing all the required information as soon as possible, you can rest easy and use all the wonderful benefits of a Paysera account without disturbances in the future.

If the account is not fully verified, Paysera may stop the transfer to prevent fraud or money laundering.

Solution: To make sure your account is up-to-date, simply log in to your Paysera account, go to your profile, and check if you submitted your identity documents and answered all questions in the questionnaire. If you have any questions or concerns, please don’t hesitate to reach out to our support team.

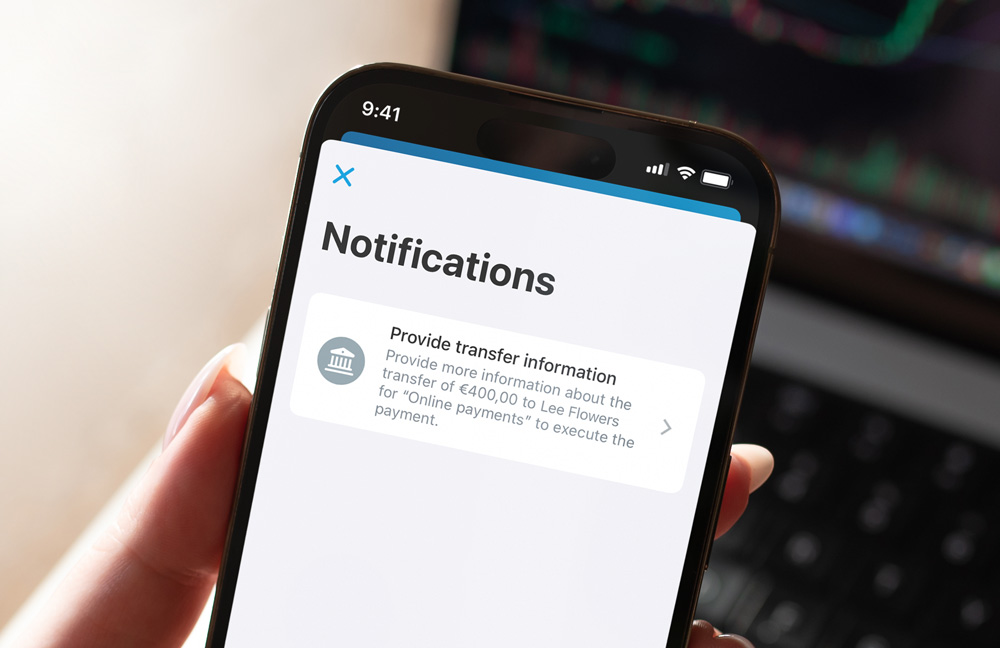

Did you provide all required information about the transfer?

Here’s a simple way to find out if more information is needed – only one of your transfers is stopped, while the other transfers are not affected.

This happens when a particular transfer lacks information or there’s reason to believe that it might be suspicious.

Naturally, you don’t have to guess and rely on assumptions in this case, as we’ll be sure to contact you and ask for additional information that is relevant specifically to your situation.

Solution: To prevent any disruptions, we recommend providing as much information as possible when you fill out the transfer form. And if any uncertainties do arise, effective communication is key! By staying in touch with us and promptly providing any additional information, you can help make sure your transfer is processed without delay.

If you've already provided the required additional information, please don't worry – our team is carefully reviewing your information to prevent any errors. Thanks for choosing our service, and we appreciate your patience as we work to process your transfer!

What documents are accepted for identification?

Before we jump into the list, let's go over a few important things to keep in mind when submitting your documents. To help ensure that everything goes smoothly, please ensure that all of your documents are in colour, have a machine-readable zone, and are clear and undamaged. Also, please keep in mind that we can't accept documents that are expired or handwritten.

The following documents are required for your identification:

- Passport

- Identity card

- Residence permit

Upload additional documents

In some cases, you may be asked to provide the following documents (or other types of documents) as well. Please note that these types of documents can only be submitted via online banking:

- Work permit

- Work visa

- Long term visa

- Temporary residence certificate

- Employment contract

Let’s sum it up with a short checklist

If you worry that you might forget what to check – we’ve prepared a checklist for you! Feel free to download it and use it.

Still having trouble? No worries, just contact Paysera’s client support – we’re here to help!