Many companies and individuals experience difficulties in executing international money transfers from Bulgaria. We at Paysera help them make payments without any worries.

📅 June, 2019

Benefits to Bulgarian users performing international transfers

Free multicurrency Paysera account

All Paysera services, including the money transfers, whether inside the country or abroad, are connected to the Paysera account. The Paysera account is the equivalent of a bank account which has not one, but 2 different IBANs – an IBAN in BGN and an IBAN in EUR. Moreover, the account can contain many currencies at the same time. 30 different currencies, to be precise. Very few other institutions similar to us can provide such functionality in just one account.

How exactly does this benefit you? First of all, no more account opening and monthly fees, both for personal and company accounts. Secondly, you can keep all your funds in different currencies in just one account. Yes, it is that convenient. And, with a Paysera account you can do everything you can with a standard bank account – execute transfers, view account statements, exchange currency, and receive money. All of that and more, with much lower costs.

Unlike most standard payment accounts, the Paysera account opening process is fully digital, which is the main reason why the service is free – without any account opening or monthly maintenance fees. The lack of fees for the account enables you - our clients, to save money and time, without having to visit a branch or fill in a pile of unnecessary documentation.

How does it work?

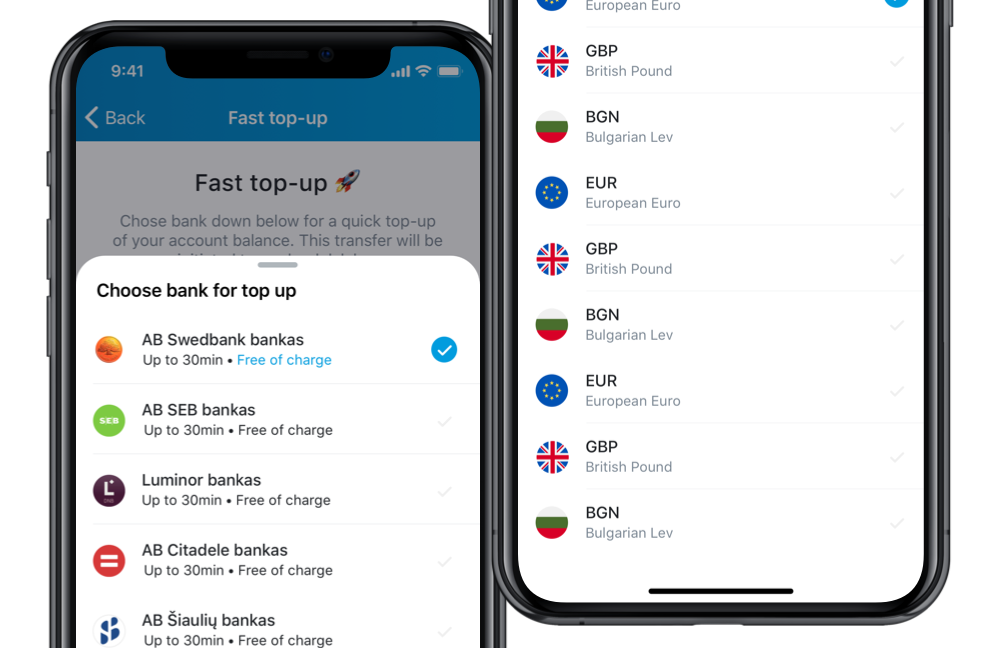

Account top-up and currency exchange

You can benefit from our services as long as you register on www.paysera.bg, finish your registration, and, of course, top up your account. In Bulgaria, this can be done via bank transfer in BGN from an account in a Bulgarian bank directly to your BG IBAN in Paysera. We won’t charge you any fees for this transaction, but bear in mind that you may be charged by your bank with a minimum fee.

Once the funds reach your Paysera account, you can exchange them into one or more of the 30 currencies we support, at one of the best exchange rates on the market. We really do try to offer the best rates on the market. This is why we compare the rates of different banks/financial institutions in the country, and choose the best one for you.

Payment execution

Because we want to offer you the opportunity to perform transfers worldwide, we partner with many banks and payment institutions around the world. Thanks to this, today you can perform money transfers to over 180 countries via our platform. That’s almost 2/3 of the world!

We also provide you with different opportunities to execute payments, depending on your needs. You can execute standard, urgent, and instant transfers. The latter are only available in EUR in the EU, are completely free of charge for individuals, 0.29 EUR for companies, and are executed in less than 10 seconds!

Here is a brief example of how our platform and services can save you money compared to a standard pricelist in Bulgaria:

Let’s say your company executes around 2-3 money transfers for around 15 000 EUR.

Here are the fees that you would pay in each institution, per month:

Bank А: 15 000*0,20% (min 20 EUR) = 30 EUR; 30 EUR*3 = 90 EUR

Bank B: 15 000*0,15% (min 25 EUR) = 25 EUR; 25 EUR*3 = 75 EUR

Paysera: 0.15 EUR fixed fee; 0.15 EUR*3 = 0.45 EUR

Therefore, on a yearly basis, we can help you save over 1000 EUR on fees and commissions for transfers alone.

Bank А: 90 EUR*12 = 1080 EUR

Bank B: 75 EUR*12 = 900 EUR

Paysera: 0.45 EUR*12 = 5.4 EUR

Unbelievable, right? Well, it’s true. Every day we are getting charged with unreasonable fees for many things. We at Paysera want to help you with at least one of them.

Continue following our blog for more valuable content.